Table of Contents

- 1 How to Calculate Amazon Storage Costs?

- 2 What Are Amazon Monthly Storage Fees?

- 3 What Are Amazon Monthly Storage Fees for Dangerous Goods?

- 4 What Are Amazon Long-Term Storage Fees?

- 5 How to Avoid Being Charged Long-Term Fees?

- 6 Tips for Sellers to Avoid Amazon Storage Fees

- 7 Can You Identify Units that Are at Amazon Long-Term Storage Fees Risk?

As the title suggests, this article is about Amazon storage fees. It is worth noting that this is not the only commission Amazon charges. However, it is one of the biggest fees sellers face.

So let’s take a look at what Amazon storage fees are, how to calculate Amazon FBA storage fees, and if it’s possible to avoid them.

How to Calculate Amazon Storage Costs?

The base for Amazon seller storage fees is FIFO accounting. Do you know what this abbreviation means?

First In First Out (FIFO) is a deduction from the FBA inventory of items sold or removed in the Amazon store for a long time. That applies to all products, without exception.

Amazon inventory storage fees depend on the number of cubic feet the product occupies in the platform’s warehouse. It is worth noting that the measurement of the occupied area comes from the unit size, packed according to the rules of Amazon and ready for shipment.

Can sellers calculate it themselves? Yes! Do you know the dimensions of the packaged product in inches? So you can estimate the Amazon storage cost right now. Here’s what you need to do for this:

- Multiply the length of the unit by the height and width.

- Divide the number by 12 to get the size in cubic feet.

What Are Amazon Monthly Storage Fees?

Amazon FBA monthly storage fees are specific fees merchants pay to the platform to store products in a warehouse. The payment amount varies based on the so-called size tiers, namely, standard size and oversize dimensions.

Those who sell on the marketplace pay a monthly commission between the 7th and 15th. So, for example, in September, during the above period, you pay for August.

As already mentioned, the monthly commission depends on the size of the unit and the area it occupies. However, the season also affects commissions. For example, the service price is higher a few months before the New Year holidays. As you may have guessed, this is due to the high fulfillment center workload because of many orders.

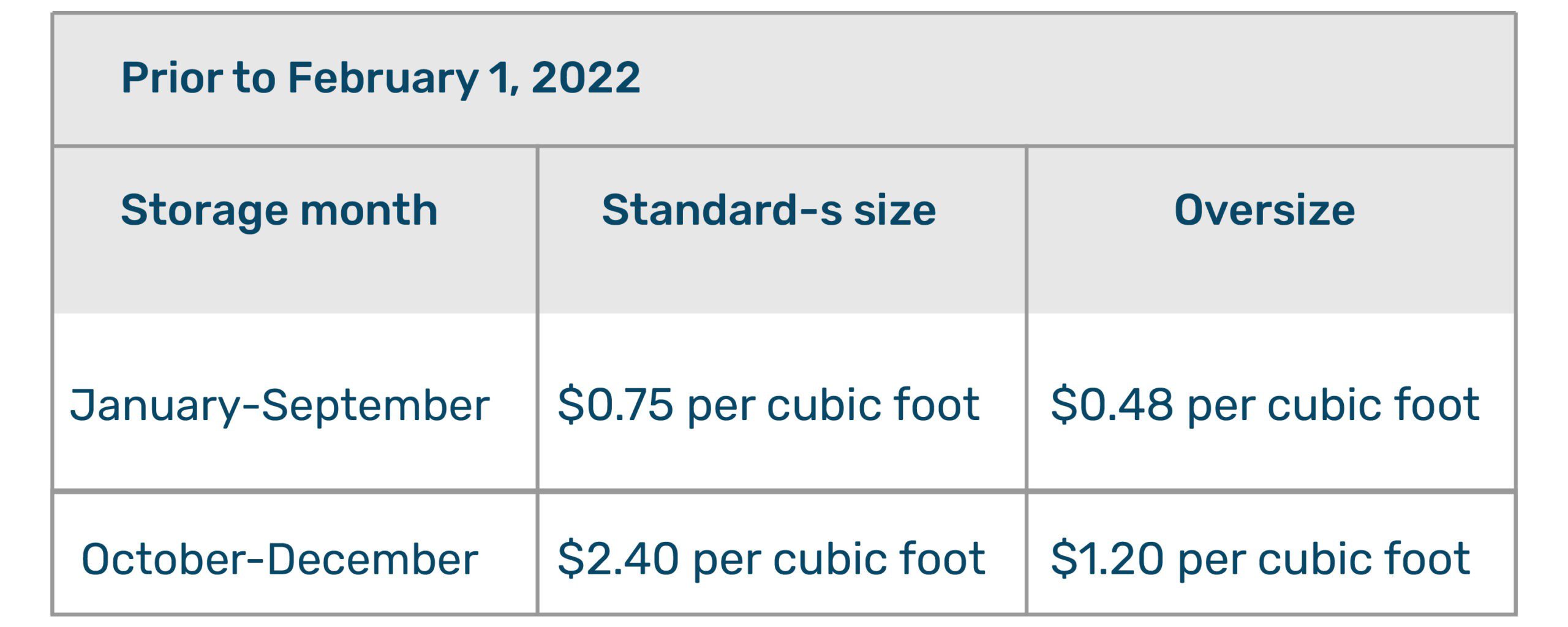

For standard-size goods, monthly storage commissions are:

- the period from January to September – $0.75;

- the period from October to December – $2.40.

For oversize goods, monthly storage commissions are:

- the period from January to September – $0.48;

- the period from October to December – $1.20.

What Are Amazon Monthly Storage Fees for Dangerous Goods?

If your product belongs to the category of dangerous goods, then the commission is more expensive per item. Hazardous means storing materials that can only be kept intact through the special treat. Amazon sellers must be FBA Dangerous Goods authorized to trade such products.

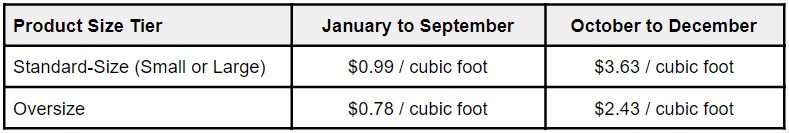

Let’s check Amazon warehouse fees per cubic foot for this case:

- the period from January to September – $0.99;

- the period from October to December – $3.63.

If the unit is oversized, then:

- the period from January to September – $0.78;

- the period from October to December – $2.43.

What Are Amazon Long-Term Storage Fees?

We have sorted out Amazon fulfillment storage fees for a month, and now let’s get down to the long-term ones. The type of commission the seller pays for storing goods for pallets for more than a year (365 days).

So, the marketplace is cleaning the warehouse every month on the 15th. An inventory owner with an item in the fulfillment center for more than a year pays $6.90 per cubic foot. Depending on which metric is higher, the merchant may also pay $0.15 per unit.

Please note that FBA programs like Small and Light products incur different fees, including long-term storage fees on Amazon. Here, the amount is $0.25 per unit for a long-term inventory period of 181 to 365 days. If it is in the fulfillment center for more than 365 days, then $0.50 (per item).

How to Avoid Being Charged Long-Term Fees?

Why does the platform do this? Because it doesn’t want to be a warehouse. That is not where AMZ make the bulk of its money. So if you are not selling inventory, it will fine you for leaving your merchandise in its fulfillment centers.

If you are at risk of being charged long-term storage commissions, you have a few options:

- Submit your removal order by 11:59 p.m. (PT) on the 14th of the month. It will help to avoid having those products incur fees, even if the next inventory cleanup doesn’t physically remove them. Removal order costs are charged only when the stock is disposed of or returned to the seller.

- Add automated removals, which help you designate products for disposal based on your automatic long-term storage commission removal settings. You can either pick to have all goods removed that will incur long-term storage expenses or only goods within a specified price range. You can decide to remove products below a specific cost while keeping higher-priced inventory as well, meaning you would only pay the commissions for the products you are not removing. The removed stock will either be returned to you or disposed of.

- Isolate the goods at risk of incurring fees in a particular advertising campaign with the purpose of liquidation. Promote aggressively to get those items purchased and out of storage quickly. The aim of this campaign is not advertising effectiveness that grows your profit. Instead, it sells through inventory fast at advertising spend that is less than the long-term storage costs. Getting reviews for your goods is vital because clients make purchasing decisions based on your feedback. Learn how SageMailer can help you with this task.

- Liquidate the goods by keeping them down at least 20% and moving them through Amazon Outlet.

Removing goods can influence the amount of new inventory you can send to AMZ under the FBA solution. The number of new products you are eligible to ship is based on sales in the prior 90 days, estimated sales for the next eight weeks, in-stock goods, inventory utilization, and other aspects.

Long-term storage expenses will also influence your Inventory Performance Index (IPI), impacting your capacity to fully use FBA for fulfillment and storage.

Like any fulfillment platform, AMZ incurs overhead expenses for inventory stored in its facilities. As a result, merchants are charged commissions based on the volume of inventory kept in their fulfillment centers, plus additional costs for things held for more than one year. However, for many FBA merchants, these commissions are a worthwhile option compared to the fees (and hassle) related to keeping their fulfillment centers and warehouses.

Tips for Sellers to Avoid Amazon Storage Fees

Since many products remain on the shelves for a long time, the following information will probably come in handy. After reviewing the guidelines, you can work out Amazon inventory storage fees reduction or avoidance.

Manage inventory by return

This method will surely stop the endless commissions. The decision is simple. Ask yourself about the potential sales levels for a given period. If you have doubts about the demand for a product, it is best to avoid unreasonable fees and return the product.

In addition, merchants can apply to remove inventory before clearing the warehouse. They can do it on the 14th of any month until 11:59 am. Note that it is Pacific time.

If you send a removal request, you no longer pay for the storage of the goods. Until the platform delivers the units to you, you do not pay for the deletion order.

Apply discount pricing

Some seasoned merchants claim that discounted merchandise is one of the safest ways to reduce commissions. So, they find it better to get a lower profit on sales than pay high inventory commissions.

After all, a decrease in trade turnover is fraught with a massive loss of profits. So wouldn’t it be better to return at least some money and reinvest it in something in higher demand?

Benefit from AMZ promotions

The gist of these promotions is that Amazon invites merchants to remove items. Besides, during this time, the seller does not pay for it. Hence, by tracking promotions, you can get a chance to lower your costs.

Also, why not add a promotion to your product? Undoubtedly, you should take its cost into account here. However, if you pay less for the promotion than for the warehouse, you sell your products and gain an advantage.

Keep track of time

Are you one of those who buy a lot of goods? Could you not send them all to AMZ? Instead, start with some part of the inventory. Once you are sure that buyers want it, you can develop an action plan.

Having a rough idea of your sales can lower your costs by knowing how much to ship. The warehouse’s most optimal and sufficient inventory is 40–45 days.

The deeper you understand selling and buying, the better you know your industry. Therefore, you must become the manager of the product you offer to people.

As you might have guessed, ignorance of the principles of inventory management is often the reason for excessive commissions.

Can You Identify Units that Are at Amazon Long-Term Storage Fees Risk?

Yes, you can do it. There are two reports that sellers use – inventory status and inventory age. Thus, they see the shelf life of the product.

Here are four easy steps to find the Inventory Age section:

- In the account, look for the “Inventory” tab

- Select Inventory Planning

- Click on “Reports” and then “Fulfillment.”

- You can now take advantage of stock status and recommended disposal reports

What’s next? Once you optimize your Amazon estimated annual storage fees, it’s high time to think about other important aspects of doing business, for example, customer feedback. Luckily, you can put this one on autopilot without logging into your Seller Central. Sign up for Sagemailer’s free trial for more information.