Table of Contents

- 1 What are Amazon VAT Invoices?

- 2 How to generate an invoice from Amazon

- 3 How does Amazon invoice generator work

- 4 How to send Amazon invoices manually

- 5 Calculate VAT rates automatically

- 6 Get rid of invoice worries on EU Amazon!

- 7 Tools and Software for Generating VAT Invoices

- 8 Best Practices for VAT Invoice Management

- 9 Common Mistakes to Avoid

If you sell on Amazon EU marketplaces, you’ve probably already faced a situation where the buyers ask you to send them a VAT invoice. For example, in France, Germany, and the United Kingdom, buyers often request invoices, even for inexpensive items. This also applies to cases where the purchase was made on business expense and a buyer needs an invoice in order to claim the VAT return from the government.

As an Amazon seller, providing your customers with a valid VAT invoice for their purchases is essential. This not only fulfills legal requirements in most countries but also fosters transparency and builds trust with your customers. In this guide, we will walk you through the steps of creating an Amazon VAT invoice.

What are Amazon VAT Invoices?

A VAT (Value-Added Tax) invoice is a vital document for businesses selling goods or services. It details transaction specifics, including the VAT charged. For Amazon sellers, issuing VAT invoices is a mandatory compliance measure when dealing with VAT-registered buyers in the European Union and other regions.

Importance of VAT Invoices

VAT invoices are more than just a legal obligation; they ensure transparent financial transactions. They allow buyers to reclaim VAT, support accurate bookkeeping, and facilitate audits. Properly managing VAT invoices can streamline your business operations and ensure compliance with tax authorities.

How to generate an invoice from Amazon

The first logical thought that comes to everyone’s head is that Amazon has already taken care of this. But, unfortunately, it is not. In matters of invoices and taxes, it’s every man for himself. Amazon does not issue VAT invoices and all responsibility for compliance with all legal requirements for issuing VAT invoices ultimately falls on the sellers.

At first glance, it seems plain and simple. You can create an Amazon FBA invoice template, type in customer’s details and calculate the VAT rate manually. But imagine that you need to do this for dozens, hundreds or even thousands of orders per month! And do not forget that different EU countries have different VAT rates! Sounds scary, isn’t it? But don’t despair, we got your back. Meet the EU VAT Invoice Generator which has been made to simplify your Amazon Europe invoicing. And like all the features in Sagemailer, it’s extremely easy to use.

Say goodbye to manual Amazon invoicing! Now all you have to do is fill in a couple of fields, once and for all!

How does Amazon invoice generator work

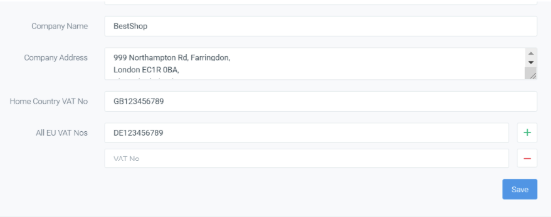

First of all, you need to fill in information about your company, which will be used in invoices, and also to list all the VAT numbers your company owns in EU.

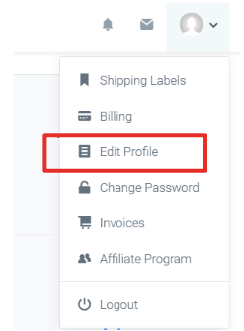

- Go to the menu in the upper right corner of the dashboard, and click Edit Profile.

- Fill in information about your company and VAT numbers. Click Save.

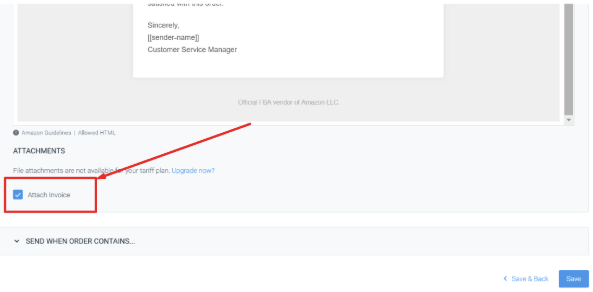

- If you want to send an invoice for each order automatically, then simply activate the Attach Invoice option on the corresponding letter’s editing page.

How to send Amazon invoices manually

- Find the corresponding order in the list of all Orders and open its page.

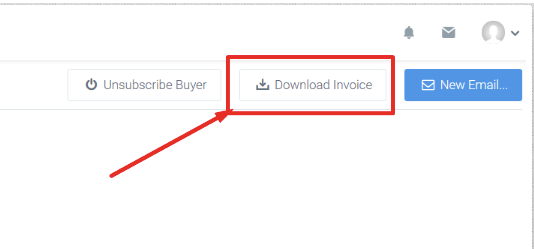

- Then you can either choose to send the invoice using your email client, to do so – just download the invoice for this order by clicking Download Invoice.

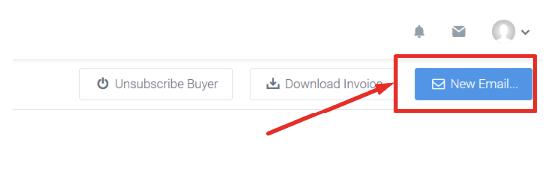

- Or send an invoice manually directly through SageMailer by clicking New Email…

On the letter page, activate the Attach Invoice function and write a short message for a customer. You can also use a pre-saved template for such cases. This greatly speeds up the process 🙂

When everything is ready, click Send.

Calculate VAT rates automatically

Have you noticed that you didn’t enter any tax rate or calculate it manually? That’s right, SageMailer counts all your VAT rates and uses EU VAT Invoice Template for every EU country automatically.

Get rid of invoice worries on EU Amazon!

Although VAT invoicing is a rather tangled and time-consuming process, but as long as you have activated a “Create an Amazon invoice” function in your profile, SageMailer will do it for you on full autopilot.

The Amazon invoice generator is available starting on Pro+ plans. Subscribe to our free 21-day trial and see how Sagemailer can simplify your invoice routine in a few clicks!

Tools and Software for Generating VAT Invoices

Creating VAT invoices manually can be a daunting task, particularly for small business owners and e-commerce sellers who handle numerous transactions daily. Thankfully, various tools and software can automate and simplify this process, ensuring accuracy and efficiency.

Recommended Tools

- Amazon Feedback & Review Software: This robust tool is not only excellent for automating feedback and review requests but also offers email automation capabilities that can assist in communicating VAT invoice details effectively.

- Dedicated VAT Invoice Software: Tools like QuickBooks, Xero, and Zoho Invoice provide comprehensive solutions for generating, sending, and managing VAT invoices.

- Amazon Seller Central Autoresponder Tools: These tools can be programmed to automatically send VAT invoices to buyers, ensuring compliance with Amazon’s policies and reducing manual workload.

Leveraging these tools can save time, reduce errors, and help maintain a professional relationship with your buyers.

Best Practices for VAT Invoice Management

Managing VAT invoices effectively is vital for compliance and smooth business operations. Implementing best practices ensures that your invoicing process is streamlined and error-free.

Keeping Accurate Records

Maintaining precise and up-to-date records of all VAT invoices is essential. This involves:

- Recording each transaction promptly.

- Ensuring all invoices contain the necessary information.

- Storing invoices securely for future reference and audits.

Periodic Reviews and Updates

Regularly reviewing and updating your VAT invoice records can prevent errors and non-compliance. Conduct periodic audits to verify the accuracy of your records and make necessary adjustments. Use software features to set reminders for routine checks and updates.

Common Mistakes to Avoid

Even with the best tools and practices, mistakes can happen. Being aware of common pitfalls can help you avoid them and maintain compliance.

Missing Information

A VAT invoice must include specific details such as the seller’s and buyer’s VAT numbers, a unique invoice number, a description of goods or services, and the VAT amount. Omitting any of these details can lead to non-compliance and potential fines.

Incorrect Calculations

Errors in calculating the VAT amount can result in incorrect invoices. Ensure that your invoicing software is configured correctly to apply the right VAT rates and accurately calculate totals.